Smart property buyers and investors who understand the value of buying property off the plan are getting the jump on other buyers. To help people looking to buy property off the plan Gehde has a simple checklist to ensure you cover off all the key considerations before you sign the contract of sale.

Buying off the plan means entering into a contract with a developer to buy a property before the completion of construction. Since there

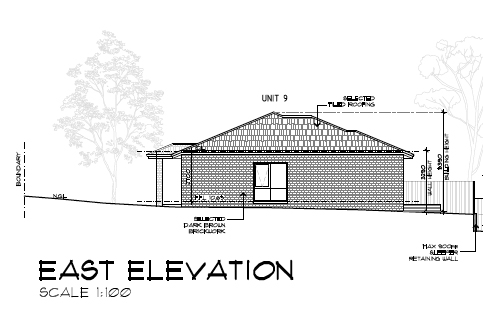

is no physical property to inspect or see, you view the design, building plans and pictures to get an idea about what the property will look like on completion.

One of the biggest advantages of buying a new home off the plan is that you will be the first owner of the property and get a brand new dwelling built just for you.

Follow the checklist below to ensure you cover all the key points before signing a contract of sale.

- Finance – Work out your budget and/or what you are able to borrow. Confirm with your lender about how they treat off the plan sales.

- Inclusions – Ask for a clear list of all fixtures and fittings, kitchen appliances, light fittings, and carpets.

- Contract details – Confirm the details that will be included in your contract. Find out if there are penalties for withdrawing from the contract. Review the contract in detail for clauses about commencement and information on your right to re-sell the property. Get the contract checked by your legal adviser.

- Builder/ developer /architect history – find out about the team doing the development so you can be confident they will deliver everything promised.

- Local market research – Investigate sales of similar properties in the local area to make sure you are paying fair market value.

- Deposit details – Be clear on what amount your deposit will be and what form it will take (cash, Bank Guarantee, Deposit Bond etc)

- Legal advice – Consult with a solicitor or conveyancer to closely check the terms of the contract to make sure your rights are protected before you sign the contract.

- Stamp duty and other costs – Make sure you work out all the costs involved with the purchase including stamp duty and other ongoing costs like Owners Corporation fees.

You can always discuss your expectations with the sales agent or developer to ensure you are clear about what you are buying. Make sure there is mutual agreement with the developer on some or all of your expectations and have them written into the contract. This will help avoid disagreement between both parties at the time of completion. Remember, if it is not in the contract it is unlikely you will get it included in the finished property.

With a little understanding, buying property off the plan can be a way of securing a good quality home at a fair market price, and then influencing how it will be finished so it suits your style and needs.

You can grab a full copy of the Simple Guide to Buying Property Off the Plan from our website. Or watch the Guide to Off the Plan video series.